Some Of Mortgage Companies In Knoxville Tn

Table of ContentsMortgage Lenders In Knoxville Tn Things To Know Before You BuyOur Mortgage Companies StatementsMortgage Lenders - QuestionsThe Main Principles Of Mortgage Lenders In Knoxville Tn All About Mortgage Lenders In Knoxville Tn

The passion price is additionally flexible. The credit rating line also grows over time based on its adjustable interest price.If you want to change the options later, you can do this is by paying an administrative cost, Stearns claimed. If you intend to remain in your house for a very long time in your retirement and also have no need to give your home to your children, after that a reverse home mortgage may help you.

If you don't fully recognize the home mortgage, you must likewise avoid it. "These are intricate items," Nelson stated. "It's a mind twister to consider equity disappearing."If you intend to leave your residence to your youngsters after you die or vacate the home, a reverse home mortgage isn't an excellent choice for you either.

Some Of Mortgage Companies

If these problems aren't met, the spouse can face foreclosure. For reverse mortgages gotten before Aug. 4, 2014, non-borrowing spouses have less defenses. The lending institution does not need to permit the non-borrowing partner to remain in the house after the customer dies. A customer as well as his or her spouse can ask a lender to put on HUD to permit the non-borrowing spouse to remain in the house.

"People don't look at reverse mortgages up until it comes to be a requirement. There are other means for senior citizens to open the equity they built up in their residences over the decades without taking out a reverse home mortgage.

Not known Factual Statements About Mortgage Lenders

The drawback is surrendering the family house. Possible upsides include moving closer to household and also purchasing a residence a lot more suitable for aging in place. You can either re-finance or get a new mortgage if you don't have an existing one as well as cash money out several of the equity.

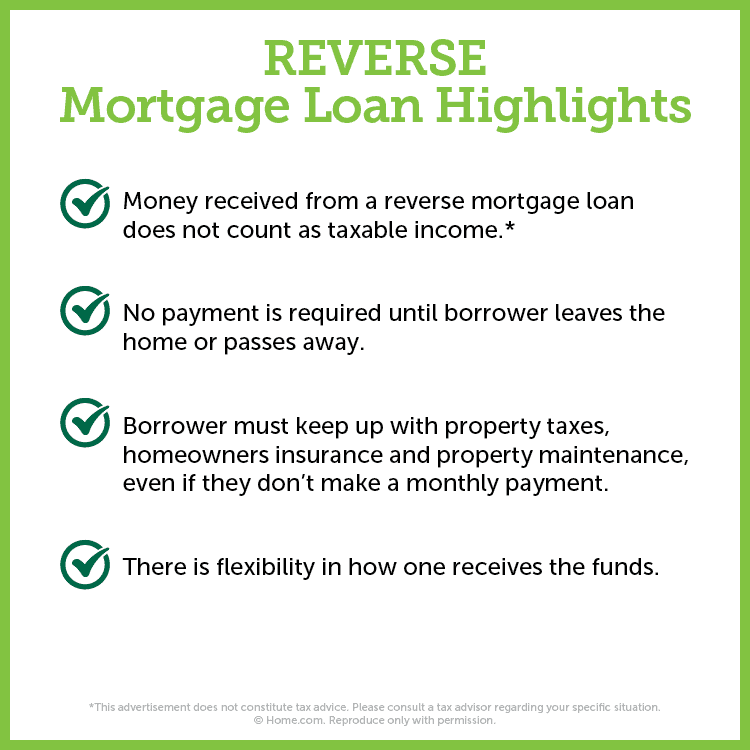

A reverse mortgage works by allowing homeowners age 62 and also older to obtain from their house's equity without having to make monthly mortgage settlements. One of the most typical type of reverse mortgage is the Residence Equity Conversion Home Mortgage (), a program guaranteed by the because 1988. The amount of This Site funds available from a reverse home mortgage are based upon the age of the youngest customer, home worth, as well as current rate of interest.

Funds obtained are tax-free as well as may be used for virtually anything. The payment of the funding is required check here when the last enduring debtor vacates the residence permanently or fails to keep real estate tax and also property owner's insurance policy. When the finance is paid back, any kind of staying equity is passed to successors or nevertheless your will certainly or count on determines.

The 10-Second Trick For Mortgage Companies In Knoxville Tn

A reverse home mortgage is various from a typical or "onward" loan, in that it runs specifically in opposite. A reverse home mortgage is a dropping equity, increasing financial obligation funding.

As you attract out funds and as interest accrues on the funding, the equilibrium expands and your equity setting in the property ends up being smaller sized. There is never ever a settlement due on a reverse home mortgage and also there is never a prepayment fine of any kind of kind. You can make a repayment any time, approximately as well as consisting of settlement in complete, scot-free.

The Principal Limit official website of the loan is determined based on the age of the youngest consumer since the program utilizes actuarial tables to identify how lengthy borrowers are most likely to remain to build up interest. If there are numerous debtors, the age of the youngest borrower will certainly decrease the amount readily available since the terms allow all debtors to stay in the house for the remainder of their lives without having to make a repayment.

A Biased View of Mortgage Companies In Knoxville Tn

As an instance. A couple, born in 1951 as well as own outright a $500,000 residence, may decide it is time to get a reverse mortgage. The pair would certainly such as $100,000 at near make some renovations to their residential or commercial property as well as fund a college strategy for their grandchild. They have a bigger social protection advantage that will certainly start in 4 years, yet till after that, wish to enhance their earnings by $1,000 monthly.